What Happens If You Stop Paying Your Credit Card in the US

If you’re even thinking about this question, chances are you’re under pressure.

Maybe the minimum payment jumped. Maybe interest rates are eating your paycheck. Or maybe you’re choosing between rent and your credit card bill.

It’s more common than people admit. With average credit card interest rates hovering above 20 percent in recent years, even responsible borrowers can fall behind fast. But stopping payment completely has serious financial consequences.

Let’s walk through what actually happens if you stop paying your credit card in the US — month by month — and what your realistic debt relief options are before things spiral.

First, Understand How Credit Card Debt Works

Credit cards are unsecured debt. That means there’s no collateral like a car or house backing it. Because of that, lenders charge higher interest rates to offset risk.

If you miss payments, the bank can’t repossess property. But they can:

- Charge late fees

- Raise your interest rate (penalty APR)

- Report you to credit bureaus

- Send your account to collections

- Sue you for the balance

That last part surprises many people. Yes, credit card companies can file a debt collection lawsuit.

Now let’s break down the timeline.

Month 1: You Miss Your First Payment

The moment you skip a payment, a few things happen quickly.

- You’re charged a late fee (typically up to $30–$41 depending on the card issuer).

- Interest continues to accrue daily.

- Your account becomes “past due.”

However, most credit card companies do not report a missed payment to credit bureaus until you are 30 days late.

If you catch up within a few weeks, the damage can be limited.

Credit Score Impact (Early Stage)

If the missed payment passes the 30-day mark, your creditor reports it to the three major credit bureaus: Experian, Equifax, and TransUnion.

Your credit score can drop:

- 60–100+ points if you previously had good credit

- Less if your credit was already damaged

Payment history makes up 35 percent of your FICO score. That’s why even one late mark hurts.

Month 2–3: 60 to 90 Days Late

At this stage, the situation escalates.

You may notice:

- Repeated phone calls from the issuer

- Letters demanding payment

- Penalty APR activated (sometimes 29.99% or higher)

- Additional late fees

Your credit report now shows 60-day and then 90-day delinquency. Each update makes lenders see you as higher risk.

If you apply for a mortgage, auto loan, or personal loan during this period, approval becomes difficult.

This is when many borrowers start searching for:

- Credit card debt relief programs

- Debt consolidation loans

- Hardship programs

And this is a critical decision point.

Month 4–6: Account Charged Off

If you stop paying for about 180 days, the credit card company will likely “charge off” your account.

A charge-off does not mean the debt disappears.

It means the creditor writes it off as a loss for accounting purposes. The balance is still legally owed.

After charge-off:

- Your credit score drops significantly

- The account may be sold to a debt collection agency

- Collection calls intensify

A charge-off remains on your credit report for seven years from the first missed payment.

This is where long-term financial consequences begin.

What Happens When Your Debt Goes to Collections

Once a collection agency owns or manages the debt, things change.

Collectors may:

- Call and send letters regularly

- Offer settlement discounts

- Report the collection account on your credit report

A collection account damages your credit score further, even if the original charge-off is already listed.

You may receive settlement offers like:

- “Pay 50% to close the account”

- “Lump sum discount”

While tempting, settlements have tax implications. Forgiven debt over $600 may be considered taxable income by the IRS.

This is rarely mentioned in shallow articles, but it matters.

More from Blogs : Apple Foldable Phone – Why World is Eager for the Future

Can You Be Sued for Credit Card Debt?

Yes.

If the balance is large enough, the creditor or collection agency may file a lawsuit.

This usually happens within the statute of limitations, which varies by state (often 3–6 years).

If you ignore a lawsuit:

- The court may issue a default judgment

- Your wages could be garnished (depending on state law)

- Bank accounts could be levied

This is where legal risk becomes real.

High balances and strong income increase the likelihood of a lawsuit. Smaller debts sometimes stay in collections without court action, but there’s no guarantee.

Long-Term Credit Damage

Stopping credit card payments can affect:

- Mortgage approval

- Apartment rental applications

- Car financing rates

- Insurance premiums

- Employment background checks

Many employers run credit checks for finance-related roles.

Even after you pay or settle, the negative mark remains for up to seven years.

That’s why understanding debt management strategies early is smarter than ignoring the problem.

What Are Your Options Before It Gets That Far?

If you’re struggling, you have options that don’t involve completely stopping payment.

1. Hardship Programs

Many credit card issuers offer temporary hardship plans if you call before defaulting.

They may:

- Reduce interest rates

- Waive late fees

- Set up structured repayment

This preserves your relationship with the lender.

2. Debt Consolidation Loan

A debt consolidation loan combines multiple high-interest credit cards into one lower-interest personal loan.

This works best if:

- Your credit score is still decent

- You have stable income

It can reduce interest costs significantly.

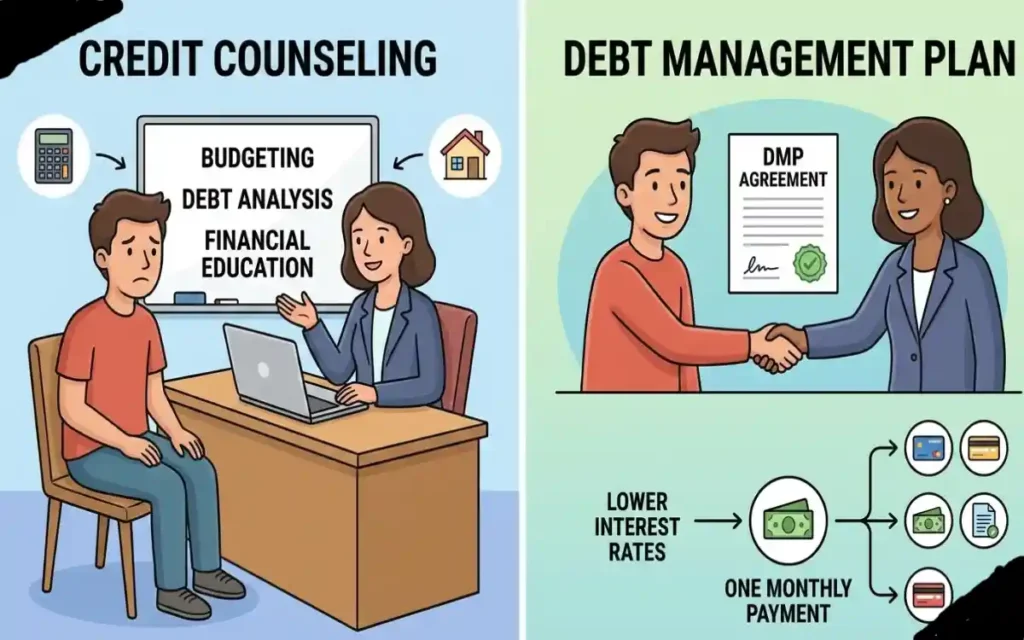

3. Credit Counseling and Debt Management Plans

Nonprofit credit counseling agencies can negotiate lower interest rates on your behalf.

You make one monthly payment to the agency, and they distribute it to creditors.

This can help avoid charge-offs and lawsuits.

4. Debt Settlement

Debt settlement companies negotiate to pay less than what you owe.

However:

- Your credit score will drop

- Fees can be high

- Tax consequences may apply

It’s usually considered when you’re already severely behind.

5. Bankruptcy (Last Resort)

Filing Chapter 7 or Chapter 13 bankruptcy can discharge or restructure credit card debt.

But bankruptcy stays on your credit report:

- 10 years for Chapter 7

- 7 years for Chapter 13

This is a serious legal decision that requires consulting a bankruptcy attorney.

Is It Ever Smart to Stop Paying?

In rare situations, some financial advisors discuss “strategic default” when bankruptcy is inevitable.

But for most people, simply stopping payments without a structured plan leads to:

- Credit score collapse

- Collection stress

- Legal risk

The emotional toll alone can be exhausting.

If you’re overwhelmed, the smarter move is to explore formal debt relief options rather than silent default.

How to Minimize Damage If You’ve Already Stopped Paying

If you’re already 60+ days behind:

- Stop ignoring calls.

- Ask about hardship options.

- Request written settlement offers.

- Avoid giving collectors direct bank access.

- Consider speaking with a consumer law attorney if sued.

Taking action reduces long-term harm.

The Bigger Financial Lesson

Credit card debt is expensive because it’s convenient.

Minimum payments create the illusion of control while interest compounds quietly.

Stopping payments feels like relief in the moment. But without a plan, it often creates larger problems down the road.

The key is not panic. It’s strategy.

My Opinion

If you stop paying your credit card in the US, the process unfolds predictably:

- 30 days: Late mark hits your credit

- 60–90 days: Deeper delinquency

- 180 days: Charge-off

- Afterward: Collections or lawsuit risk

The financial consequences are real, but so are your options.

If you’re struggling, the smartest move is early communication and structured debt relief planning.

Avoid silence. Avoid denial. Take control before the timeline controls you.