BRICS vs G7 economy: How It’s Reshaping Prices, Power, and America’s Role in the World

If your grocery bill or online shopping cart feels more painful lately, tariffs are a big part of the story. Under President Trump’s new trade agenda, tariffs are once again front-page news. But this isn’t just about higher costs at Walmart or Target—it’s about a global chess match involving America’s rivals, allies, and the very currency that underpins the world economy. Let’s unpack the ripple effects of these tariffs, how BRICS nations are changing the global balance, and why the dollar itself is under pressure.

Tariffs Hit Home: Why Your Wallet Is Feeling Lighter

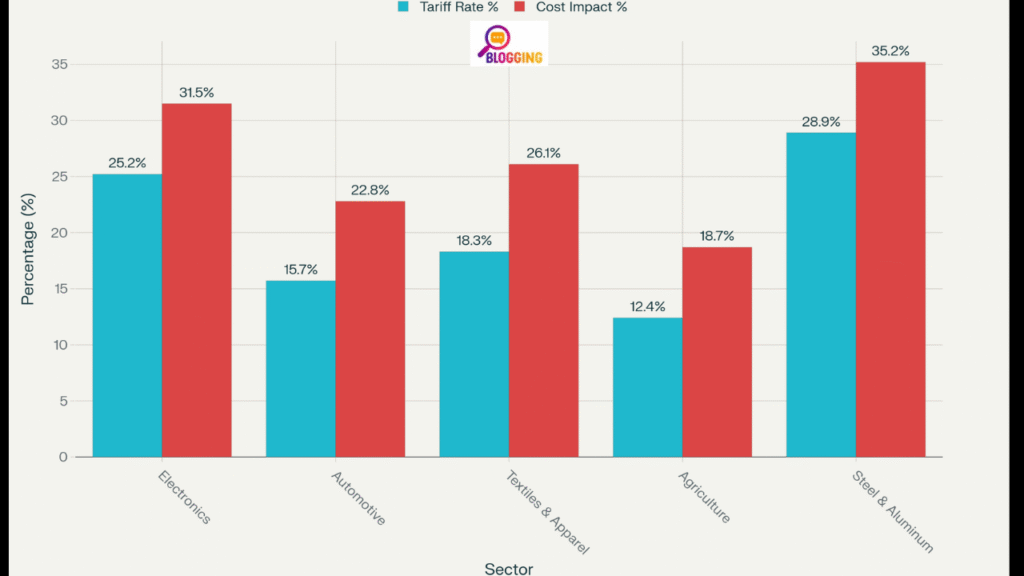

Tariffs are essentially taxes on imported goods, and when companies pay more to bring products into the U.S., they pass those costs directly to consumers. Trump’s renewed tariff blitz is hitting key sectors of the economy hard:

- Electronics → Facing 25% tariffs, prices are climbing by about 10%. Big-name manufacturers are relocating production from China to Vietnam and India to soften the blow, but those shifts take time and costs still land on consumers.

- Automobiles → With tariffs around 25%, costs are rising about 15%. Carmakers are redirecting supply chains from China to Mexico. That means new cars and even used cars will carry a steeper sticker price.

- Agriculture → Farmers are being hit with a double whammy. A 20% tariff means a 25% cost spike for buyers, and retaliatory moves from China are cutting off one of America’s largest export markets. For U.S. farmers, that’s devastating.

- Steel & Aluminum → Tariffs of 25% are raising costs by 20%. While this may help revive some U.S. production, it also makes construction, appliances, and even beer cans more expensive.

What does this mean for you? Higher grocery bills, pricier gadgets, and cars that feel out of reach. As the holiday season approaches, shoppers should brace for fewer deals and higher prices.

Beyond Borders: BRICS vs G7 economy in the New World Economy

While tariffs dominate headlines in the U.S., another quiet revolution is happening on the global stage: the rise of BRICS. The five-nation bloc—Brazil, Russia, India, China, and South Africa—represents a massive counterweight to the traditional G7 (U.S., Canada, U.K., France, Germany, Italy, and Japan).

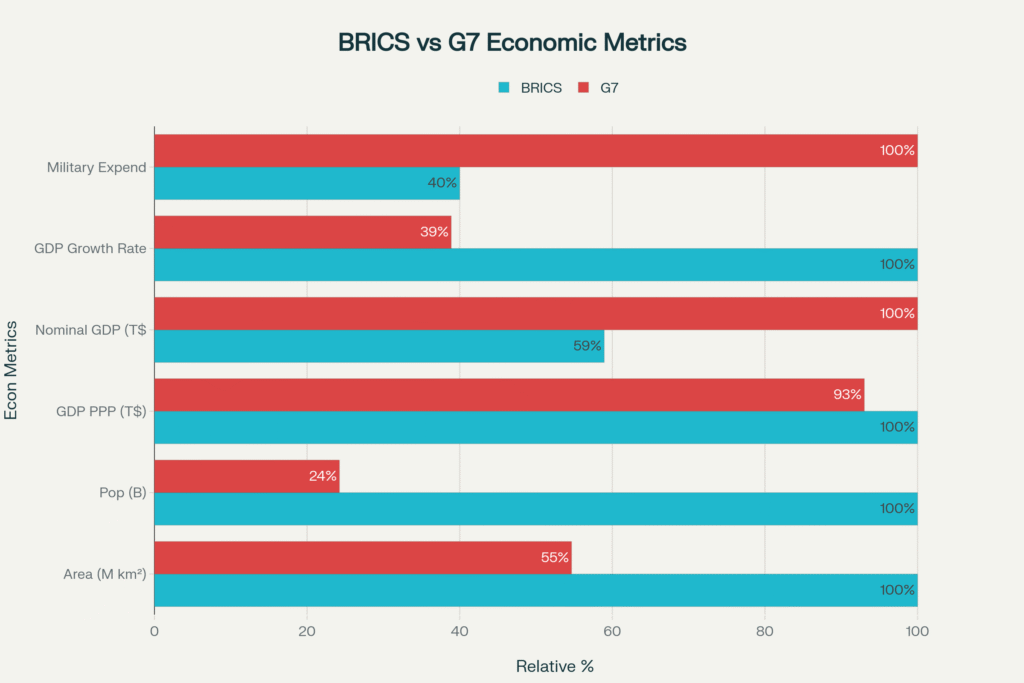

The numbers tell the story:

- Population → BRICS: 3.3 billion vs. G7: 0.8 billion. BRICS has four times as many people, which means a much larger consumer base and labor force.

- Land Area → BRICS: 39.7 million km² vs. G7: 21.7 million km². BRICS holds more natural resources and territory.

- GDP (Purchasing Power Parity) → BRICS: $51.6 trillion vs. G7: $48 trillion. On a PPP basis—which measures how much money can buy in each country—BRICS is already bigger.

- Nominal GDP → G7 still leads at $45.3 trillion compared to BRICS’ $26.7 trillion. But BRICS is closing the gap.

The takeaway: BRICS has the people, the land, and growing economic clout, while the G7 still dominates finance and innovation. But the momentum is shifting—and fast.

Read also:-Top Smartphone Technologies in 2025-The Future of Smartphones is Here!

The Dollar Under Siege: De-Dollarization on the Rise

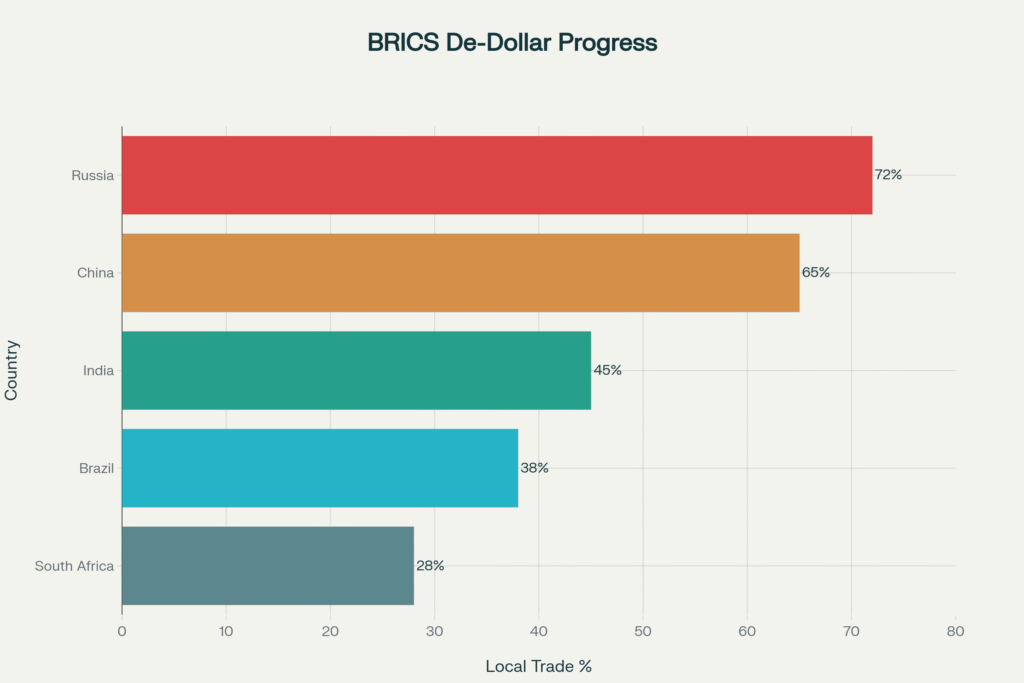

For decades, the U.S. dollar has been the global reserve currency, meaning it’s the standard for trade, debt, and savings worldwide. That dominance gave America enormous leverage—sanctions bite harder, and tariffs hit deeper when everything is priced in dollars. But now, BRICS nations are quietly building workarounds.

- Russia → After sanctions, 90% of its trade now happens in rubles or other local currencies. Russia uses its own SPFS payment system instead of SWIFT.

- China → Nearly half of its trade is now in yuan. China’s CIPS system is gaining traction as an alternative to the dollar-dominated banking networks.

- India → Pushing “Rupee Vostro” accounts to settle trade in rupees rather than dollars.

- Brazil & South Africa → Leaning into local currency swaps and regional clearing systems.

This trend is called de-dollarization, and while it won’t dethrone the dollar overnight, it chips away at America’s financial superpower status. The more other countries reduce their reliance on the dollar, the harder it becomes for the U.S. to use tariffs and sanctions as tools of leverage.

What It All Means for Americans

So how do tariffs, BRICS, and de-dollarization connect to your daily life? Here are the key takeaways:

- Higher Prices Everywhere → From iPhones to pickup trucks, tariffs are raising costs. Even if companies move factories out of China, those costs don’t vanish—they shift elsewhere.

- New “Made In” Labels → Expect to see more products stamped with “Made in Mexico,” “Made in Vietnam,” or “Made in India” as supply chains adapt.

- Dollar Trouble = Inflation Risk → If fewer countries use the dollar, America could face higher borrowing costs and persistent inflation. That affects everything from mortgages to credit cards.

- Geopolitical Uncertainty → As BRICS strengthens and the dollar weakens, America’s ability to set the rules of global trade diminishes.

The Big Picture

Trump’s tariffs may be framed as a way to protect American workers, but in practice, they’re making life more expensive at home while fueling rival alliances abroad. The BRICS nations are seizing the moment, pushing for more independence from the U.S.-led financial system. Meanwhile, the dollar—long considered untouchable—is facing its first real tests in decades.

For everyday Americans, that means higher costs today and more uncertainty tomorrow. For policymakers, it means rethinking how the U.S. competes in a world where its rivals are bigger, more coordinated, and less dependent on the dollar.

The tariff war isn’t just a trade fight—it’s part of a much bigger battle over who gets to call the shots in the global economy.